The Hayne Royal Commission has been described as “one of the most consequential royal commissions ever conducted in Australia”.

By Dr Vicky Comino, Senior Lecturer, TC Beirne School of Law

The evidence and scale of misconduct within the banking sector, which was unearthed and made public by forensic analysis of the counsel assisting, is far worse than anyone imagined. And the commission’s interim report has been widely regarded as a “game-changer”.

After earlier such inquiries, apologies and stated commitments to restore trust were regarded as enough to rebuild community goodwill and get back to business.

In his interim report, Hayne characterised this as the “bad apples” argument, which served as a limited concession to acknowledging there were “isolated pockets of poor culture” within the sector.

Hayne is having none of that.

Asking what could have caused such behaviour, he says the answer is “greed” and short-termism trumping respect for the law and customers. In his view, the aggressive sales-driven culture of banks – one that puts profits and growth above customers’ interests – and the incentive systems that reinforce it lie at the heart of most, if not all, of the bad behaviour.

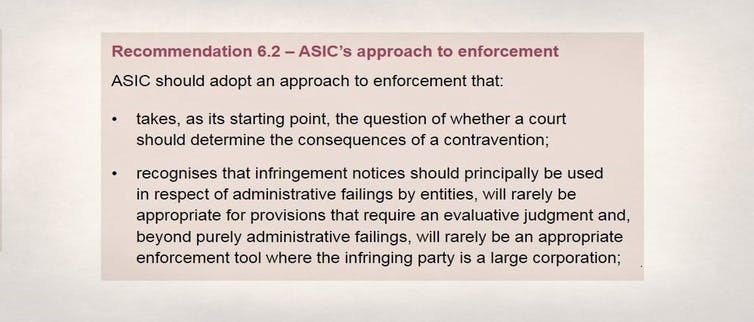

The corporate enforcers get blamed too. Hayne says the Australian Securities and Investments Commission (ASIC) has rarely gone to court. And the Australian Prudential Regulation Authority (APRA)? Never.

Hayne has promised much…

The commissioner has referred 24 institutions and individuals to authorities for investigation and possible civil and criminal action.

He has said that in future the starting point has to be not “how can we resolve this by negotiation”, but “why not litigate?”

He adds that misconduct, especially if it yields a profit, will not be deterred by merely requiring wrongdoers to pay compensation.

While resorting to negotiated settlements in the form of enforceable undertakings and infringement notices has been understandable (they avoid the cost, time and uncertainty involved in taking on high profile, well-resourced wrongdoers), they neither deter nor seriously punish misconduct.

…but it might not be delivered

Question marks hang over whether Commissioner Hayne’s recommendations will be implemented, and if they are, whether they will be enough to address the systemic problems revealed.

Despite the government saying it will take action on all 76 recommendations, [1] regrettably, there have already been signs that it may be softening on its “resolve” to rein in the banks.

For instance, in response to criticisms about a delay in making the report public, Prime Minister Scott Morrison told ABC’s 7.30 Report that “you don’t go shocking the markets”.[2] In effect, he was saying that it was needed to make sure that Hayne’s findings, which the government anticipated would be damning, did not have an instant and potentially explosive impact on the shares of Australia’s big banks.

ASIC and APRA will need to be better resourced if they are given new powers and responsibilities and expected to bring more cases to court.

The government recently restored the ASIC funding removed in earlier budget cuts. And, last week, Treasurer Josh Frydenberg said that additional funding would be provided to ASIC and APRA, as well as the Commonwealth Director of Public Prosecutions and Federal Court,[3] but this may not happen.

Australian Banking Association CEO Anna Bligh also stated that “banks accept full responsibility” for how they have “failed their customers and let down the Australian public” and “know that they must now change”.[4]

But if history is anything to go by, it is hard not to be “cynical” (as Bligh urges the public not to be),[5] about the banks and their willingness and capacity to lead and enforce real change. It’s also impossible to ignore the likelihood of the banks starting a new lobbying campaign, if they haven’t already, to water down any future legislation and/or restrictions on their operations, resulting from Hayne’s recommendations. This is something Hayne indicated he expected.[6]

Throughout the royal commission, we heard consistent rumblings from within the industry, warning that any tightening of lending requirements will cause the already troubled housing market, to crash.[7] In other words, the cost will fall on bank customers. However, it has also been observed that what is missing in this argument is that the cost of misbehaviour by banks has already been borne by customers.[8] Their widespread practice of ‘fees for no service’ is a clear example.

While Hayne has said that the primary responsibility for misconduct lies with the entities concerned and those who manage and control them, including their boards and senior management, he fears that the gap between the public face that banks seek to show and what they do in practice (culture, governance and remuneration), remains.

He said this in light of the evidence given by Mr Thorbun (NAB’s CEO) and Mr Henry (NAB’s chair) in the face of questioning in the final Round of public hearings, demonstrating an “unwillingness to recognise, and accept responsibility for misconduct”,[9] which has since seen these bank executives dramatically announcing their departures from NAB.

However, the question remains regarding whether they are just ‘symbolic scalps’ sacrificed in an effort to restore faith in an industry that, despite clear evidence, and some ‘acknowledgement’ of problems, has shown itself overall to be in denial about systemic cultural issues being at play in most, if not all, of the scandals that have plagued Australian banks over the past decade.

[1] The Hon Josh Frydenberg MP, Joint Media Release with The Hon Scott Morrison MP, “Restoring trust in Australia’s financial system”, 4 February 2019 at <https://treasury.gov.au/publication/p2019-fsrc-response/>

[2] See Justin Sungil Park, ”Labor attacks PM over banks report timing”, SBS, 30 January 2019 at <https://www.sbs.com.au/yourlanguage/korean/en/article/2019/01/30/labor-attacks-pm-over-banks-report-timing>

[3] The Hon Josh Frydenberg MP, Media Release, “Labor puts politics ahead of policy in responding to royal commission”, 6 February 2019

[4] ABA, Media Release, “Statement from ABA CEO Anna Bligh on the release of the Final Report of the Royal Commission”, 4 February 2019 at <http://www.ausbanking.org.au/media/media-releases/media-release-2019/statement-from-aba-ceo-anna-bligh-on-the-release-of-the-final-report-of-the>

[5] Ibid.

[6] Final Report of the Hayne Royal Commission, 1 February 2019, vol1, 16 at <https://treasury.gov.au/publication/p2019-fsrc-final-report/>

[7] See Ian Verrander, “Post royal commission report, banks will start a new lobbying campaign – but customers pick up the bill”, ABC News, 4 February 2019 at <https://www.abc.net.au/news/2019-02-04/royal-commission-banks-customer-will-pay/10778394>

[8] Ibid.

[9] Ibid, 409.